In our monthly independent review of branded recommerce, we take a look at which brands and retailers launched resale programs and the potential impact on the planet.

BRANDS WITH RESALE SHOPS

TOTAL RESALE SHOP LISTINGS

YOY RESALE SHOP GROWTH

Only resale listings that are available from a brand’s e-commerce site are counted towards that brand. See methodology.

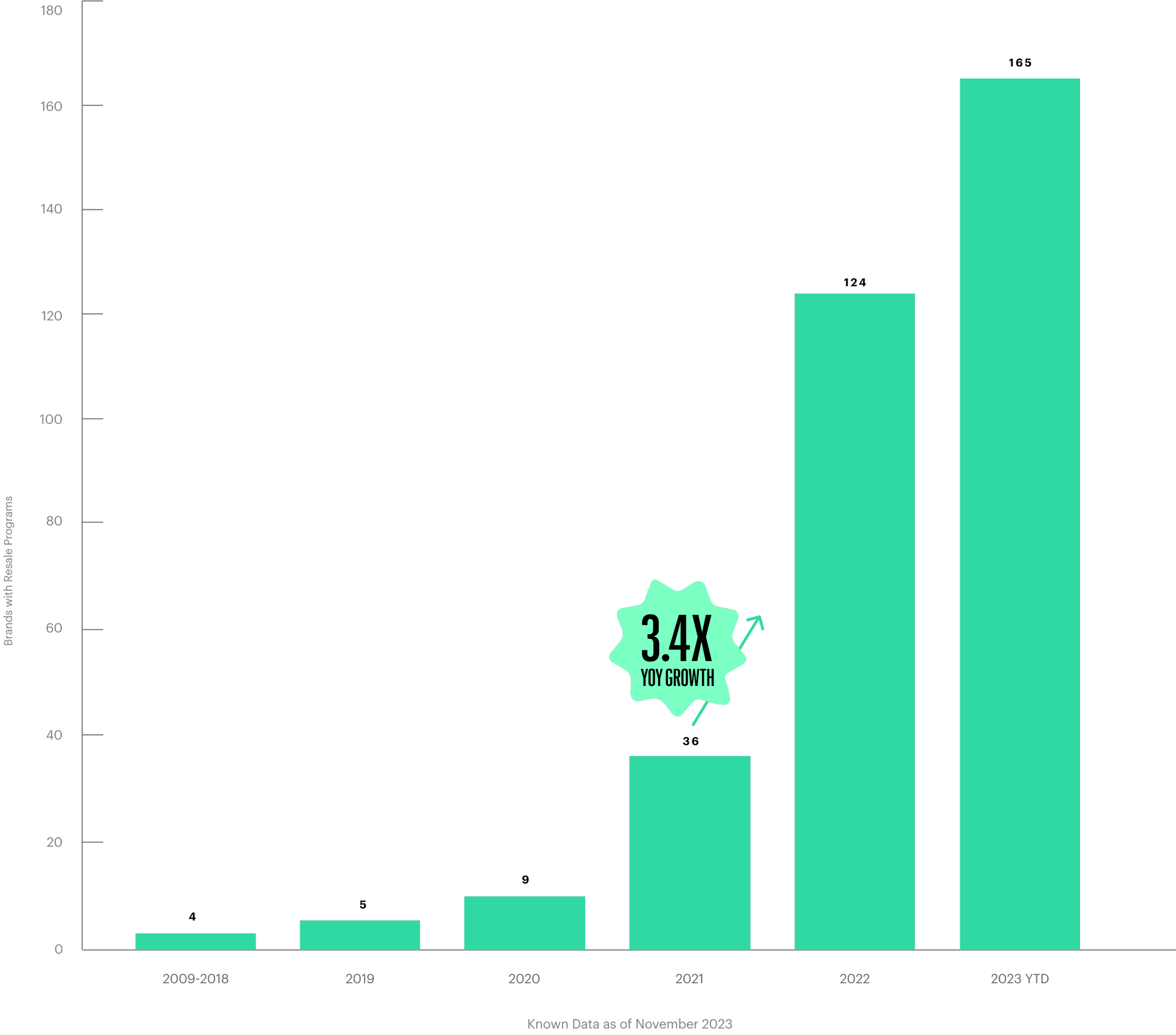

Brands’ Adoption of Resale is Accelerating

Circular Fashion News & Resources

-

Why everyone got sold on resale in 2022

– Retail Brew

-

For Kate Spade, resale is a customer acquisition tool

– Glossy

-

Branded Resale Surpasses 100 Programs and Counting, as of September

– WWD

-

Big retailers are getting into the secondhand market. Will that change how we shop?

– Grist

-

The Recommerce 100 is compiled from publicly available information to identify fashion brands selling their own brand’s pre-owned products online to US shoppers. Only resale listings that are available from a brand’s e-commerce site are counted towards that brand. Listing count includes listings managed by the brand, as well as listings by independent sellers (commonly referred to as peer-to-peer selling). A count of listings was completed between November 27 and 28, 2023. Listing count either reflects 1) the stated number of total results commonly found at the top of the first product listing page, or 2) if results are not featured on the product listing page, a manual count of all listings. Listing count is intended to be directionally representative of the size of a brand’s resale shop at a given time. There is no guarantee that our listing count is exact given the dynamic nature of e-commerce listings, sales, returns, as well as site and user experience factors. Listing counts do not include listings on third-party marketplaces (examples include thredup.com, therealreal.com, poshmark.com). thredUP Resale-as-a-Service™ clients are counted among the brands and retailers with Resale Shops (e.g. Athleta, Tommy Hilfiger, Madewell and PacSun).

Resale shop launch year is compiled based on publicly available information from sources including statements on brand websites, media coverage, brand social media posts or inquiries to brands’ customer service.

Estimated resale shop penetration is modeled using publicly available information on brand annual revenue, listing counts (see above listing count methodology) and a survey of listing prices.

*Change versus resale shops identified and listings counted as of September 2023.

Published December 2023

-

The Recommerce 100 contains estimates, based on publicly available information as of the published date of data collection expressed in the Methodology, and therefore involves a number of assumptions and limitations. thredUP has not independently verified the publicly available information and cannot guarantee accuracy or completeness of the information. Resale shop listings, resale shop launch year, estimated resale sales value (as a percent of brands’ total publicly stated revenue), and the presence of an evergreen clothing take back program (for recycling, donation, or resale) are therefore subject to a high degree of uncertainty, especially as resale is a new and rapidly changing segment. These and other factors could cause actual numbers to differ materially from those expressed. We do not guarantee that the Recommerce 100 includes every fashion brand selling its own pre-owned products online to US shoppers.

Except as required by law, thredUP assumes no obligation to update any report after the published date of data collection. thredUP intends to publish the Recommerce 100 on a monthly basis.